Refinancing could offer many benefits, such as for instance reducing your interest and you will/and/or term of your own financing. It’s also possible to need to re-finance for individuals who want to create a great deal more guarantee. Cutting your price because of the as little as 0.50% might help you save thousands of dollars inside compound focus.

Peters conveyed people should just down their monthly payment, going from a 15-season loan to help you a thirty-season one.

For those who do not intend to remain long in their home, they can shorten the loan, the guy explained. To see you skill to switch the mortgage problem, I will suggest talking to a loan provider. You will find a familiar myth that this entire process is difficult, but if you work at a loan provider, it could be relatively easy to help you re-finance.

- To lower monthly obligations

- When deciding to take benefit of an improved credit rating

- Accomplish an earnings-away refinance, utilising the collateral built in the house to help you borrow funds your may want to generate household home improvements or perhaps to shelter knowledge otherwise scientific expenditures once you don’t possess use of almost every other fund.

Peters noted there are numerous considerations and then make before refinancing, like expertise your ultimate goal within the refinancing; the fresh new projected property value your house; as well as your latest home loan repayments.

That have pricing in the a most-day lower, it will be smart to communicate with a lender otherwise banker to see if refinancing is right for you, the guy emphasized. Inquiries you will flip through this site want to question would be to concentrate on the expenses associated with doing so loan and how quickly or whether or not or perhaps not you are going to recoup those people will cost you.

The application Number: Preparing is vital

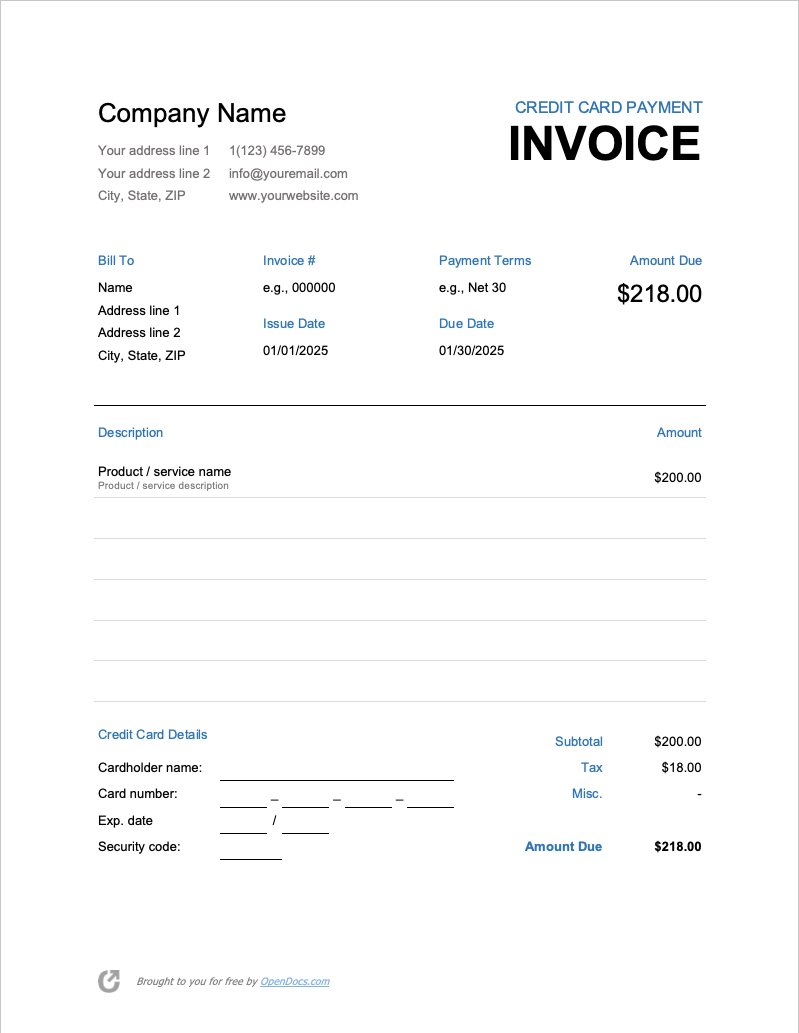

While it may seem overwhelming, Arvest Financial will walk you through the applying techniques easily. To help you get already been, you’re asked to own after the recommendations:

- Email address and you may emailing address

- Shell out stub covering the past 30 days for every candidate

- Lender comments going back a few months for everyone membership

- W-dos models over the past two years

- Newest statements for everybody 401(k) and you will IRA membership

- Societal Defense Honors page, if appropriate, and you will proof of later years/your retirement earnings

During the prequalifying procedure, might speak to a mortgage loan agent who’ll consider their borrowing from the bank and discover what you can afford. Not all the bills is actually considered, just those claimed in order to a card institution, particularly vehicle repayments, student loan payments and you will mastercard payments, said Peters.

Exactly what when the my personal borrowing is not excellent?

Even with a high obligations so you can earnings proportion, there are particular loans where you can use, he said. Due to the fact 2013, borrowing from the bank might even more available to borrowers. You prefer being qualified credit and you can earnings, evidencing power to build money, including a verified history of using debts.

Peters did explain, although not, one in earlier times year, there was more work to carry out regarding the certification procedure if perhaps you were let go due to the pandemic or if your had a corporate.

There is certainly more try to manage throughout these parts. We require an extra 1 year out-of organization lender comments. I view all of the variables, such for folks who took out financing to aid your providers, upcoming we possibly may review the new durability of one’s organization.

Getting started is simple and only requires times of your energy

Arvest Bank possess a software entitled Home4Me that enables you to definitely do everything from your mobile, requesting pre-certification, releasing our home loan query, connecting having a loan provider and navigating effortlessly in the financing process all-in a secure platform.